Sell first, pay suppliers 30 to 90 days later*

- Access working capital within bill pay

- Get upfront transparent and fixed fees

- Pay supplier bills 30 to 90 days later

Access working capital within bill pay

Get upfront transparent and fixed fees

Pay supplier bills 30 to 90 days later

How it works

Tola makes it easy for SMBs to pay suppliers on time, while giving you the flexibility to extend your payment terms 30 to 90 days later.

Get a Tola Pay later limit

Connect your business bank accounts and your accounting software.

Upload or import a bill

Select a supplier bill within your limit that you want to pay later.

Tola pays the supplier today

Select when Tola pays the supplier so funds always arrive by due date.

Pay back in 30, 60 or 90 days

Decide whether to pay Tola back and know exactly how much your fee will be.

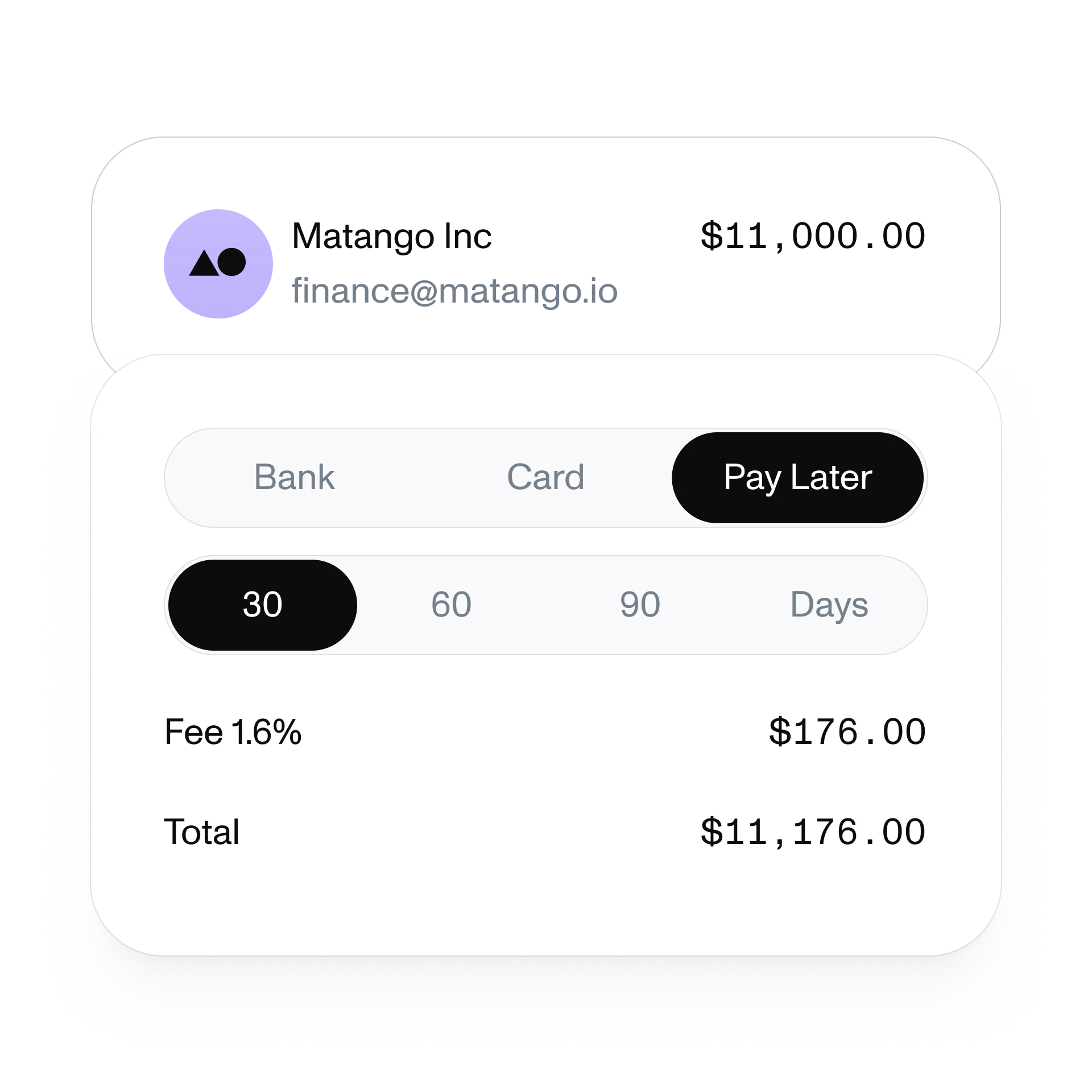

Extend your supplier or vendor payment terms by 30 to 90 days*

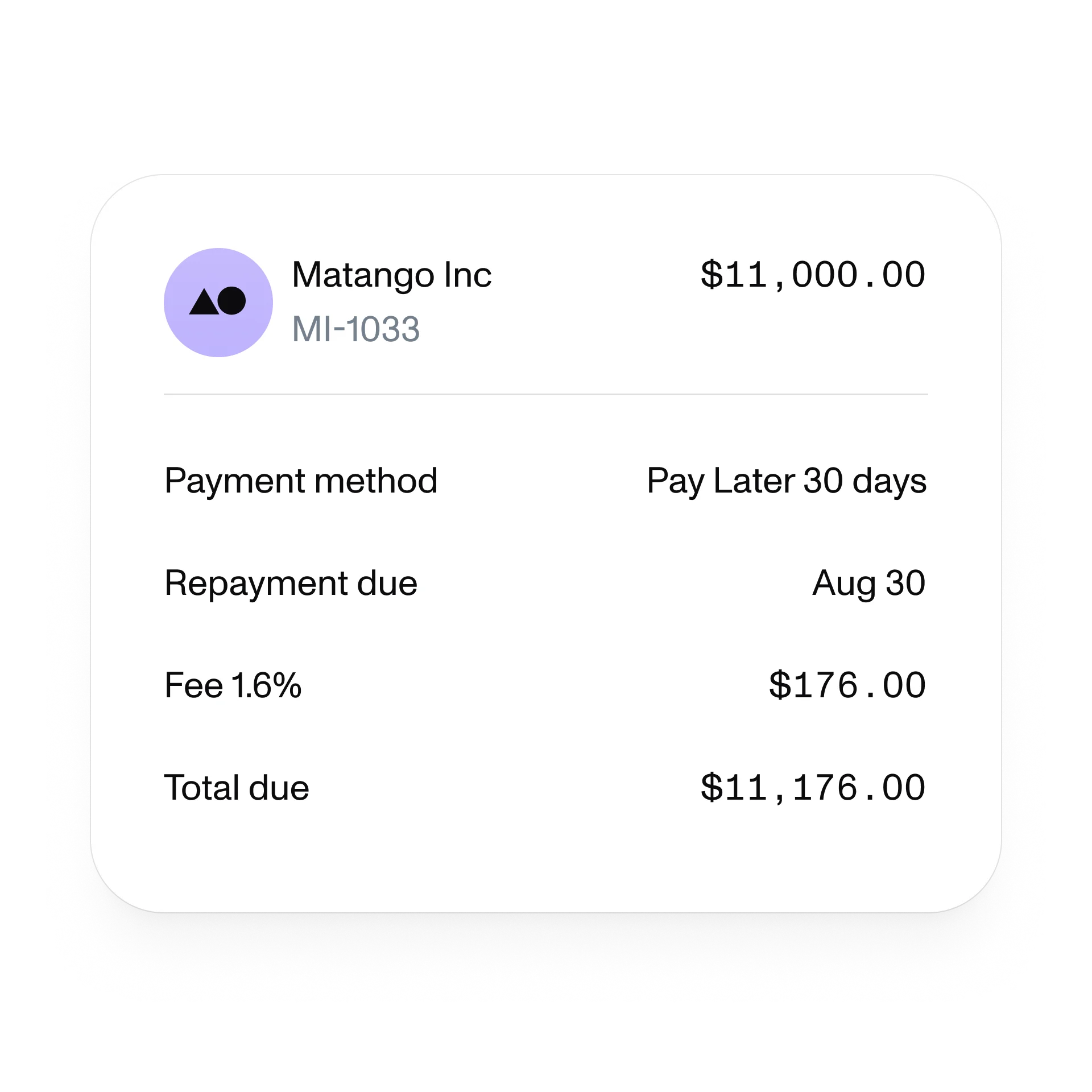

Pay later with Tola will appear as another payment option when you are paying a bill with a clear and transparent fee. Tola will pay the vendor by due date, and you can pay back in 30 to 90 days.

See transparent terms upfront and clearly defined fees

Before paying later, you will be able to see how much you will pay in fees before you pay the bill. The repayment will be deducted automatically from your bank on the selected date.

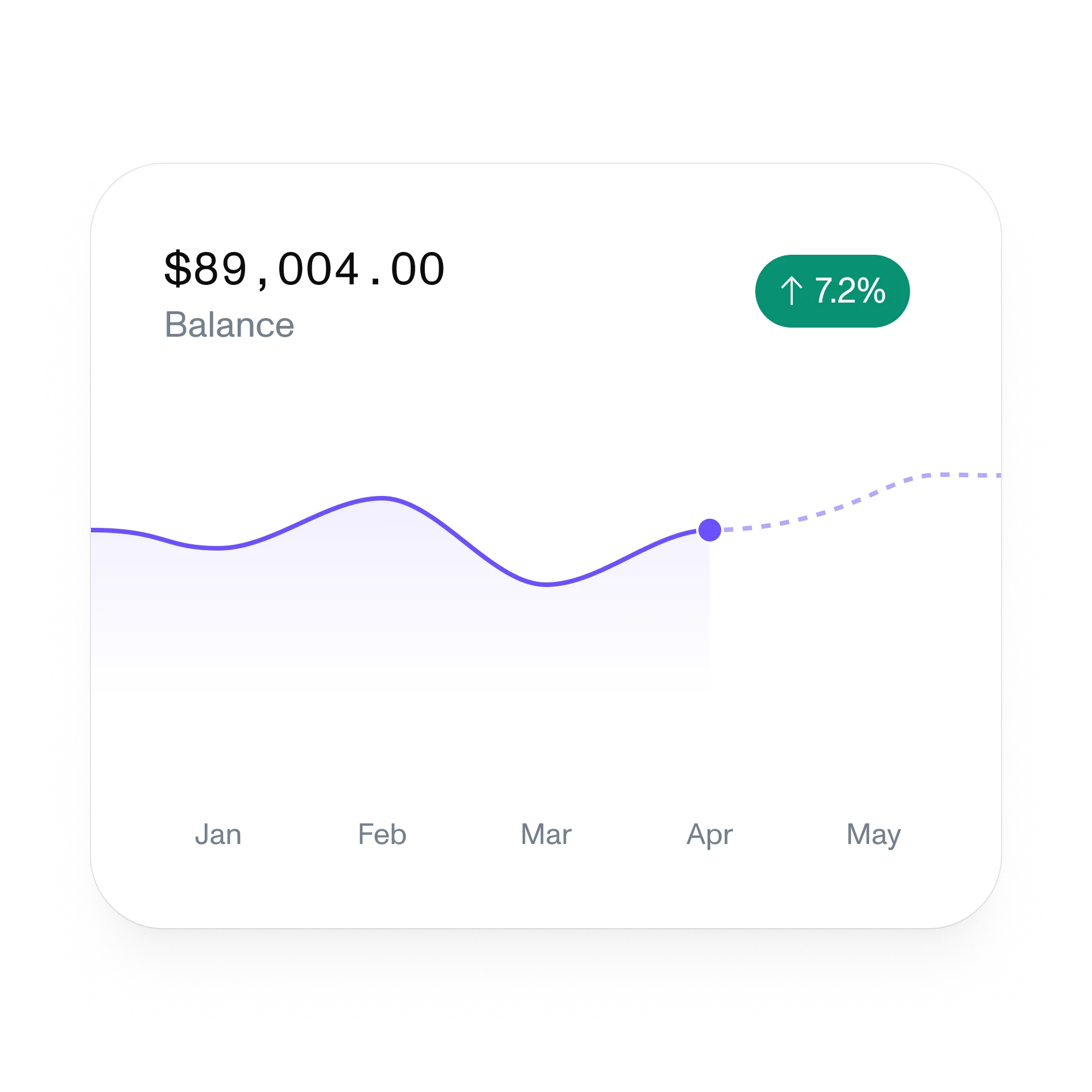

Stay on top of your cash flow and get more purchasing power

When you connect your existing bank, accounting tools and use Tola to pay and get paid, you will always be able track and grow your dynamic limit for Pay later.

Simplify your AP and working capital workflow

We have built the best in class tools to manage the requirements of any small business.

Upload and pay any bill, select how you pay and you vendor gets paid.